Hurricane Season Stocks to Watch

The 2017 Atlantic hurricane season was one of the worst on record.

All thanks to infamous trio of Harvey, Irma and Maria.

2018 was also an "above normal" season, that ushered in Florence and Michael which brought record winds and flooding to the Florida panhandle and coastal Carolina.

Harvey flooded Houston with more than four feet of rainfall as it made landfall August 25. Irma battered the Caribbean before coming ashore in the Florida Keys on September 10. And Maria destroyed homes and much of the infrastructure in Puerto Rico and inflicted a devastating disaster on the island when it came ashore on September 20.

Mother Nature was unkind, causing $250 billion of damage.

In September 2018, Hurricane Florence churned towards the east coast of the U.S. with South Carolina in its path. Folks up and down the densely populated coast were told to be ready for the worst. Forecasting models showed it could unload a foot or two of rain in places, causing devastating inland flooding. Forecasters also warned of a rising threat of life-threatening storm surge, along with the damage of a hurricane’s high winds.

2019 has ushered in Hurricane Dorian.

If you’re in the path of a hurricane, it’s just a good idea to get out of the way. Please be safe.

Hurricane-Force Investment Opportunities -- Winners

In every crisis, there’s opportunity. Hurricanes are no exception.

Some companies see a jump in costs as they repair businesses. Other companies generate more business as they supply the products and services needed in the rebuilding effort.

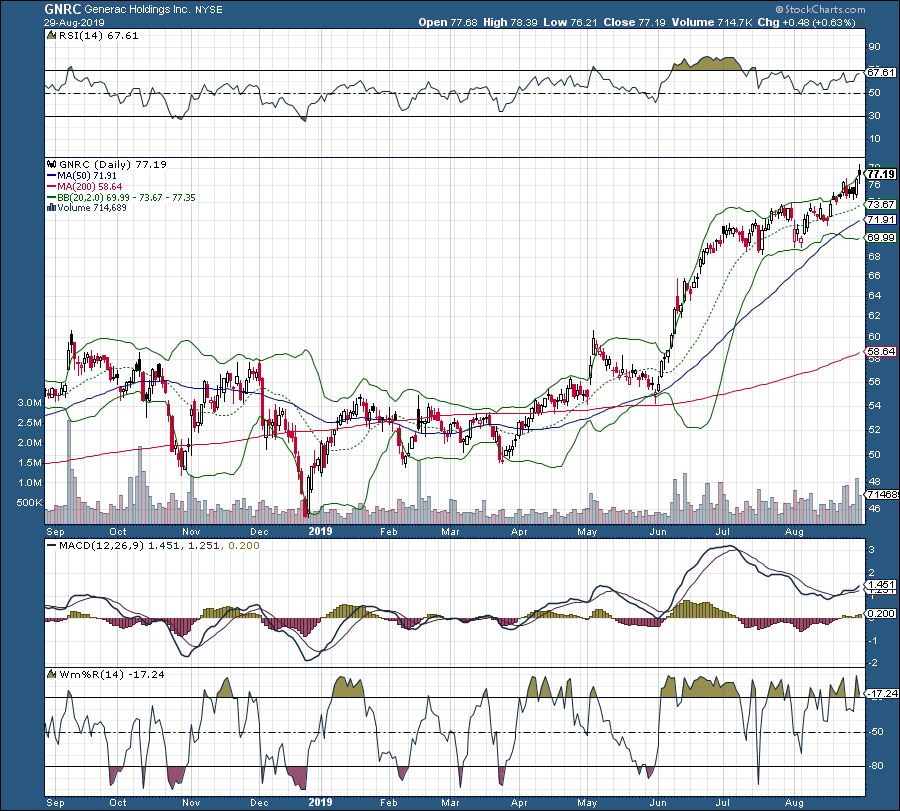

Generac Holdings (GNRC)

GNRC is a $3.65 billion leader in power generation equipment and other light-motor equipment for residential and industrial customers. The company is the market leader in home standby generators and the leading global manufacturer of mobile generators for industrial use.

Free “dummies guide” to trading options

Did you know trading options can actually be safer and more profitable than buying and selling stocks?

Best-selling author reveals his simple & safe way to start trading options in this FREE GUIDE. It’s 100% free until the end of the month.

Beyond the physical damage to homes and businesses, one of the biggest inconveniences of a powerful storm is electrical outages. It’s why in 2017, GNRC exploded from $37 to $53 before pulling back post-season.

Home Improvement Stocks

As two major hurricanes swirl in the Atlantic Ocean, investors bid up Home Depot (HD), Lowe’s (LOW) and Lumber Liquidators (LL) since they historically stand to benefit from increased sales of plywood and other home improvement goods. All three stocks exploded on the intensity of the 2017 season.

This segment is “naturally positively exposed to preparation and recovery efforts,” says Morgan Stanley. These “typically see a boost in sales post-storm as damaged property is repaired.”

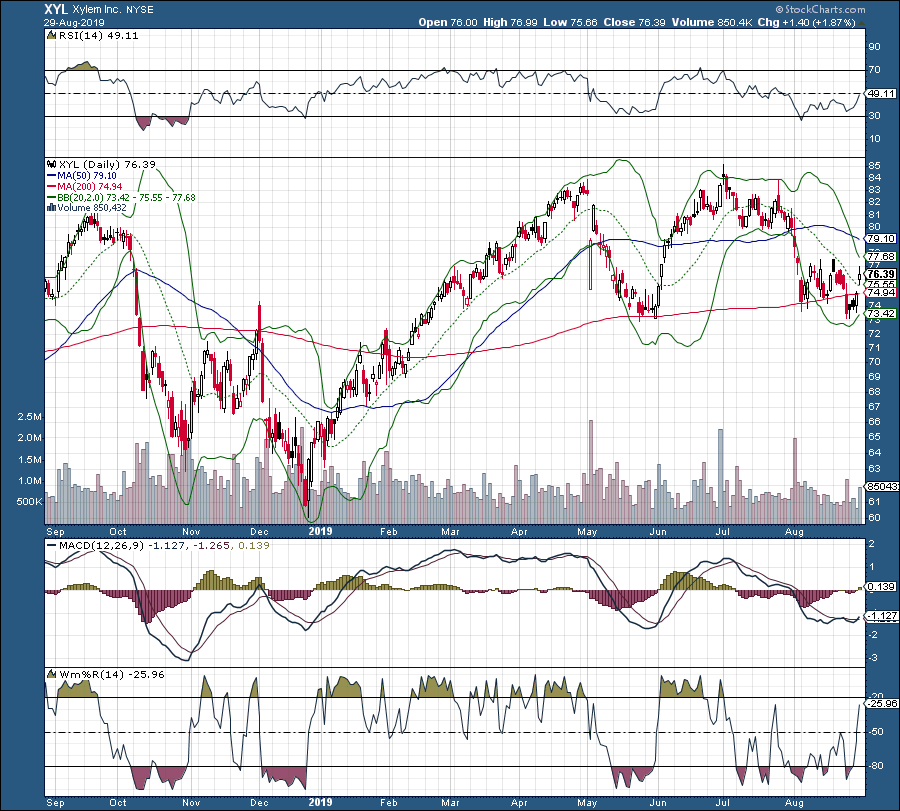

Xylem Inc. (XYL)

XYL is another one to own. It’s a global leader in water services, including testing, treating and transportation. When a massive storm hits, floodwaters can overwhelm public drinking water and mean large government contracts for making the water safe again.

Aside from those, hotel stocks may also see a benefit if people displaced from their homes are forced into temporary lodging. Even casino companies see a higher demand at times.

In fact, according to Morgan Stanley in 2017:

“Casinos, while negatively impacted in the short-term, typically see a longer-term benefit as the influx of rescue, infrastructure and construction workers into a market during the recovery period typically drives higher demand,” Morgan Stanley’s report read. It added that “casinos and hotels also typically have business interruption insurance which shields them from any potential losses.”

Hurricane-Force Investment Opportunities – Losers

Unfortunately, some of the biggest losers in any hurricane are the people. It’s why it’s essential that you protect yourself if you’re in the path of these beasts.

As for stock losers, here are some to stay away from or short temporarily.

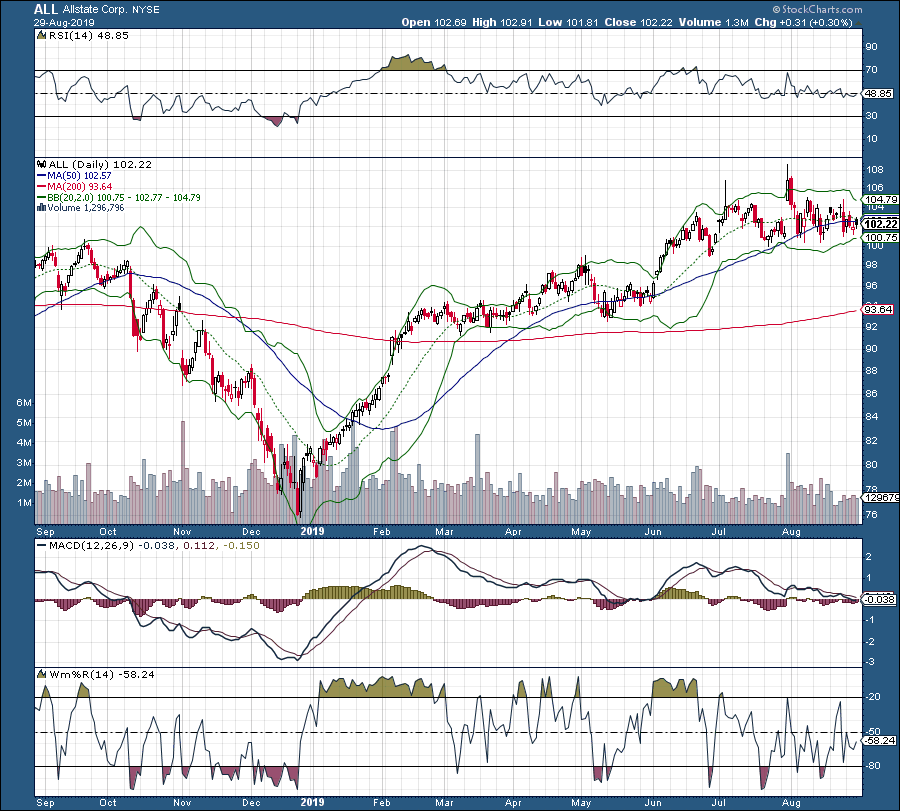

Insurance Stocks

Stocks such as Allstate Corporation (ALL) and Progressive Corporation (PGR) may take a beating once anticipation for stormy weather sets in. In 2017, ALL fell from $92.50 to about $82.50. However, once the storm was priced in, we saw a recovery.

In 2017, fell from $47.50 to $42.50. It then recovered once. The storm was priced in.

Even if insurance stocks are temporarily crippled by the storm, once the crisis has been priced in, they become buy opportunities.

While we’d prefer it if hurricanes would stay offshore, we can’t politely ask them to move.

We can profit from them, though. And we can hope for the best for those in the path.

Special Bonus Gift: Can You Control 100 shares of AAPL for less than $20 bucks?

That’s the power of trading options. In the past, trading options was risky or confusing. Not anymore. This guide – Simple Options Trading For Beginners – reveals a safe, simple and sane way to trade options. Perfect for beginners.