Trade War Resolution: Why Investors Should Remain Cautious

The trade war ceasefire between the U.S. and China set off quite a rally in December 2018.

The Dow Jones rocketed 330 points. The NASDAQ gained 117. The S&P 500 was up as much as 33. And the small-cap Russell 2000 picked up another 10 points on the day.

Even major exchanges in Hong Kong and Shanghai were up nearly 3% on the news.

Commodities gained lost ground, too. Copper prices for example were up 2%. Crude oil gained more than 5%. Soybean prices jumped 1.7%.

"I'm particularly happy for the American farmer of soybeans as they've been a sacrificial lamb in this spat but the 25% tariff on soybean imports into China still remains for now," Peter Boockvar, CIO at Bleakley Advisory Group said, quoted by CNBC.

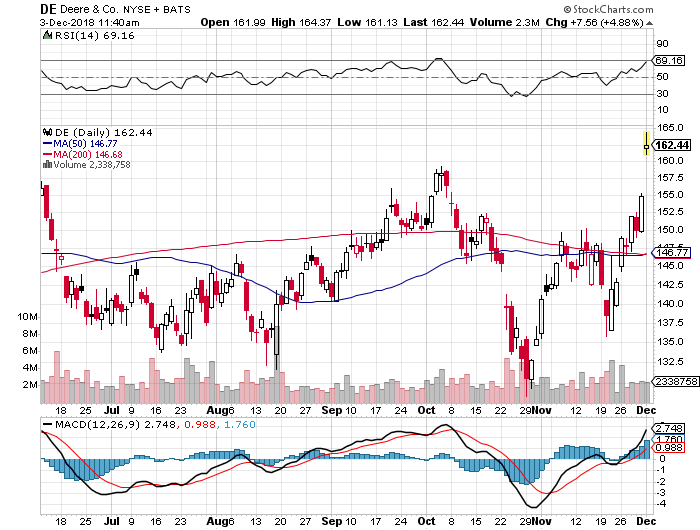

Shares of Apple (AAPL) were up as much as $4 on the news. Deere (DE) was up $7.50.

Free “dummies guide” to trading options

Did you know trading options can actually be safer and more profitable than buying and selling stocks?

Best-selling author reveals his simple & safe way to start trading options in this FREE GUIDE. It’s 100% free until the end of the month.

All thanks to a temporary 90-day truce between the two economic super powers.

President Trump agreed to maintain the 10% tariffs on $200 billion worth of Chinese goods, and not raise them to 25% ahead of a January 2019 deadline. And, China agreed to buy a substantial amount of agriculture, energy and other goods from the U.S. to help reduce the trade imbalance.

“China will agree to purchase a not yet agreed upon, but very substantial, amount of agricultural, energy, industrial, and other product from the United States to reduce the trade imbalance between our two countries. China has agreed to start purchasing agricultural product from our farmers immediately," the White House said.

China also agreed to reduce and remove tariffs on cars coming into China from the U.S., said President Trump. Currently the tariff is 40%.

However, despite the good news, markets must remain cautious.

China and the U.S. now have 90 days to sort of trade issues that have nagged both countries for quite some time. In fact, Goldman Sachs says the two most likely outcome are that the truce gets extended after 90 days or the trade war resumes, and escalates from here.

Dutch Bank ING also believes, "90 days to work out a broad agreement is very short. Especially because the agreement should also encompass a deal on more sensitive issues like the theft of intellectual property and forced technology transfers in joint ventures. Most wide-ranging bilateral trade agreements take years to negotiate,” as quoted by CNBC.

While it’s a great step forward that’s more than welcomed by global markets, we really need to see significant progress between the two economic super powers.

If not, we could see an immediate resumption of downward pressure on the markets.

Bonus Report: Can you really Control 100 shares of AAPL for less than $20 bucks? That’s the power of trading options. In the past, trading options was risky or confusing. Not anymore. This guide – Simple Options Trading For Beginners – reveals a safe, simple and sane way to trade options. Perfect for beginners.