These Aerospace and Defense ETFs could Fly High in 2018

One of the best ways to diversify at less cost is with an ETF.

In early July 2018, most defense names became very expensive.

- Raytheon (RTN) was up to $195

- Boeing (BA) traded at $336

- General Dynamics (GD) was at $187

- Northrop Grumman (NOC) was at $309

- United Technologies (UTX) was at $125

If I wanted to own just 10 shares of each, it’d cost me $11,520.

If I wanted to own 100 shares of each, now we’re up to $115,200.

At the same time, though, I can gain the same exposure to those by picking up defense ETFs, such as the SPDR S&P Aerospace & Defense ETF (XAR), which traded at $87 a share. The iShares U.S. Aerospace & Defense ETF (ITA) traded at $192 at the time.

What’s nice is that the ITA doesn’t just provide me exposure to the names listed above. In fact, as of July 2018, it offered exposure to 41 related stocks, including those above plus L3 Technologies (LLL) and Lockheed Martin (LMT).

Meanwhile, the XAR also provided good value with large, mid-cap and small-cap defense and aerospace names as well.

The question becomes – why not pay less for more?

Interesting to note, in early July 2018, many related stocks like Raytheon, Boeing and Lockheed Martin had all sunk on the idea of peaceful relations with North Korean leader Kim Jong Un, and a good deal of trade war fears.

Even as many of the defense and aerospace stocks started to show signs of bottoming out after tumbling from lofty highs, the best way to trade this group is by buying a basket of ETFs that offer you diversification at less cost.

Three of the most popular aerospace and defense ETFs, include:

SPDR S&P Aerospace & Defense ETF (XAR)

Expense Ratio: 0.35%

Price as of July 2, 2018: $87.14

The SPDR S&P Aerospace & Defense ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Aerospace & Defense Select Industry Index. It has holdings in Axon Enterprise Inc., Textron Inc., AeroVironment Inc. and Orbital ATK Inc.

Free “dummies guide” to trading options

Did you know trading options can actually be safer and more profitable than buying and selling stocks?

Best-selling author reveals his simple & safe way to start trading options in this FREE GUIDE. It’s 100% free until the end of the month.

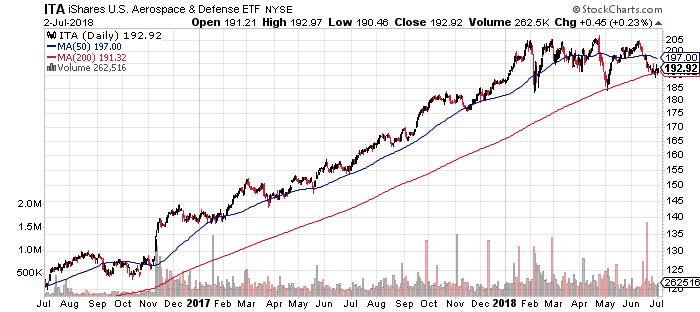

iShares U.S. Aerospace & Defense ETF (ITA)

Expense Ratio: 0.44%

Price as of July 2, 2018: $192

The iShares US Aerospace & Defense ETF invests in stocks in the domestic aerospace and defense sector. These stocks can include companies that manufacture both commercial and military aircraft as well as other types of defense-related equipment. It has holdings in Boeing, United Technologies Corporation, Lockheed Martin, Raytheon, General Dynamics, and Northrop Grumman.

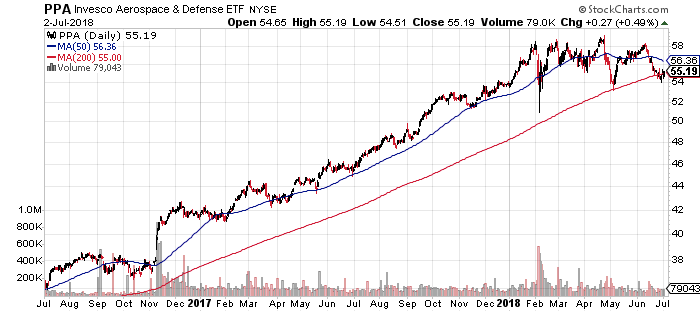

Power Shares Aerospace & Defense ETF (PPA)

Expense Ratio: 0.61%

Price as of July 2, 2018: $55.20

The Invesco Aerospace & Defense ETF tracks a market-cap-weighted index of US-listed stocks involved in the defense, military, homeland security and space industries. It has holdings in Boeing, United Technologies, Honeywell International, Raytheon, and General Dynamics.

If you're interested in adding some aerospace and defense stocks to your portfolio, consider doing so via an ETF. A well-chosen ETF can give you instant diversification across popular sectors -- and make investing and profiting from it that much easier.

Bonus Report: Can you really Control 100 shares of AAPL for less than $20 bucks? That’s the power of trading options. In the past, trading options was risky or confusing. Not anymore. This guide – Simple Options Trading For Beginners – reveals a safe, simple and sane way to trade options. Perfect for beginners.